I’m sure most people have heard the President speak about the “booming economy”, the jobs created, the low unemployment all of which he, of course, is personally responsible for. But I’m not here to criticize the President for claiming credit, I’m really here to take a closer look at the “booming economy”.

First of all, how do we measure the economy? GDP (gross domestic product) is the principal measure of the economy. It is the total value of all goods and services sold within the country’s borders. Inflation artificially increases the measured GDP so, to remove the illusion of artificial growth, inflation is factored out to obtain what we call Real GDP.

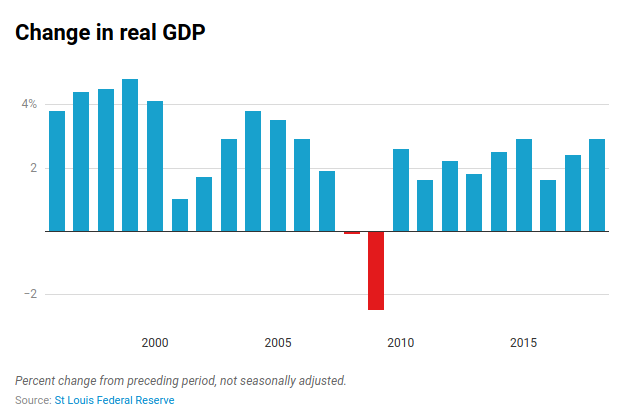

Among his many claims1, the President, in his speeches, has been touting a 3% (even 4%) growth in the economy (GDP) in the years to come. But how realistic are his projections of economic growth?

The CBO (Congressional Budget Office) projects that the real GDP growth rate will be 2% for the next several years. Now GDP growth is made up of gains in the labor force and gains in productivity. The CBO further projects that gains in the labor force will be approximately 0.5% while gains in productivity will be approximately 1.5%. But in 2019, the population growth was 0.5% (the lowest rate in over a century) so the labor force gain per capita is zero. Secondly, gains in productivity are mostly made through automation. The benefits of automation are typically not passed on to workers but distributed to executives and share holders2,3

The net result is that the lion’s share of economic growth is benefiting businesses, their executives and their stock holders, not workers. This has been going on for a long time and is the principal factor in the growing income and wealth inequality.

We can ask, whose projections of GDP growth are more likely, the President’s or the CBO’s? To the best of my knowledge, the President has no basis for projecting 3% or more GDP growth, but there is ample evidence to support the CBO’s projection. Real GDP growth is shown in the graph below for the past several years. Computing the average of these numbers from 2001 to 2018, the average growth amounts to 1.98%.

Major components of GDP are consumption, investment and government spending. The lion’s share of GDP is consumption which is the purchase of services and disposable goods. In order for consumption to rise dramatically, there has to be a dramatic rise in incomes which there is for those at the top, but not those at the bottom. But only a small fraction of the income of those at the top goes to purchasing disposable goods and services. Most goes to investments. Any dramatic rise in consumption, would therefore have to come from those in the lower quartiles of income distribution whose incomes are not rising. Thus, no significant rise in consumption appears possible and no dramatic rise in GDP appears in sight.

The bottom line of all this is that real GDP growth is very likely to grow slowly and that its growth will continue to benefit those in the top 10% income bracket while the lower 90% see little or no benefit. So, the economy may be booming, but only for a few Americans.

1 Together with “the lowest unemployment ever”, the “greatest number of jobs ever created” and so on. These will be the subjects of another blog post.

2 They are also kept as retained earnings, spent in stock buy-back programs and invested in corporate mergers/takeovers.

3 Automation also reduces gains in the labor force.