The latest proposals from the progressive Democrats running for President are the “Green New Deal” to reduce the threat of global warming, and a wish list of programs including healthcare for all, guaranteed jobs for everyone, improved education, free college tuition, rebuilt infrastructure and homes for the homeless. However, these proposals are opposed by old guard Democrats as well as Republicans. Why? Because they are unaffordable. So, is that really true?

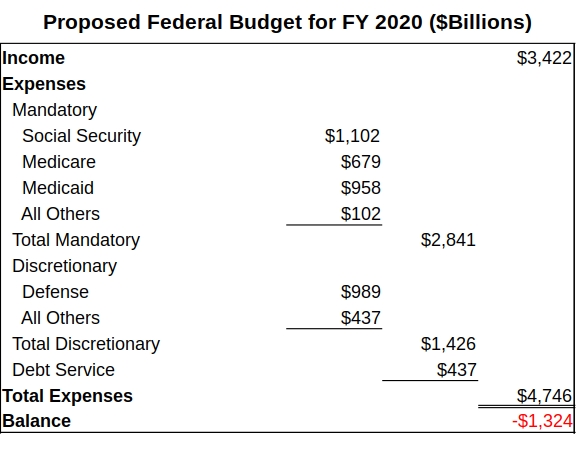

As things stand today, these proposals truly are budget busters. Why is that? Let’s take a look at the proposed budget for the next fiscal year.1

So it’s apparent there’s no money in the budget next year. How about borrowing the money? First of all, there are no reliable estimates for the total cost of all these programs, but it’s obvious we’re talking well over $1 trillion. So, considering that the current national debt is $22 trillion and the interest on that debt is nearly half a trillion dollars and growing rapidly, is it wise to add another trillion or more to the deficit?

These progressive, domestic proposals are all “nice to have” proposals, but do we “have to have” them? And if we decide we have to have them, what are we willing to give up for them? If we decide these are “have to have” proposals, we are going to have to make some drastic changes in our federal budget – which means drastic changes in our national priorities. So what are our options?

The options are 1) increase revenues, 2) cut existing expense and 3) both of the above. On the income side, recent tax cuts have severely increased the deficit2 and failed to offset the losses with increased revenues from an improved economy3. Furthermore, those tax cuts have served no useful purpose for stimulating the economy or improving the living standards of Americans. Repealing the tax cuts would restore some of the revenues, but not enough. Without cuts to spending, higher income and corporate taxes are needed just to balance the budget.

On the spending side, the lion’s share of the deficit belong to defense and healthcare costs4. Defense costs have historically risen faster than the GDP5, the reason being our increased involvement in foreign adventures (i.e. spreading democracy), build up of active duty, military personnel and procurement of advanced weapons systems in response to hypothetical threats to our national security. Approximately one third of the world’s total military expenditures are spent by the U.S. We spend more than three times the amount of the next highest spending nation, China, and approximately 10 times the amount spent by Russia6.A valid risk assessment of the threats to our national security would show that these hypothetical threats are greatly exaggerated, that the real national security risks are very low and that they don’t justify our continued involvement in foreign wars or warrant the vast expenditures to the military. Clearly, we could reduce that spending without incurring any significant risk to our national security, but we might have to give up some of our world dominance.

As for healthcare costs, overall healthcare costs have risen dramatically over the past 50 years7 and Medicare costs, in particular, have risen even more so due to our aging population8. The nation’s total healthcare expenditures are estimated at $3.5 trillion (about 18% of the GDP) and the federal government’s contribution to that cost is $1.64 trillion (nearly one half). For the government to pay the entire amount, it would have to add another $1.86 trillion to the budget. But would it really cost taxpayers more in the end? No. The $3.5 trillion healthcare cost is already paid, half by government and half by private payers, and is not going to rise simply by changing the bill payer. If anything, the costs would probably decrease as a large fraction of cost overhead could be eliminated. So the real option is whether to have a single bill payer or to continue to pay through a combination of government and numerous private insurance companies.

The bottom line is, we can reduce defense spending and increase tax revenues to produce budget surpluses which could then be used to pay down the debt and invest in progressive domestic programs. No one really knows the true cost of all the progressive proposals, and it is likely to exceed any amount that can be obtained through defense cuts and tax increases, but a good start could be made on the many of them. Healthcare for all would be a no cost change from the present and a high priority proposal for starters. Green energy conversion would be a good second as it would create jobs for people displaced by cuts in defense spending in addition to reducing the rate of global warming which threatens all of us. For the remaining proposals, we would have to wait and see what is affordable. But those are our options. Now we must choose.

Time is running out. We need to re-evaluate our national priorities and we need to do it soon. What do we really want for our nation? Do we want to continue being the world’s foremost superpower? Do we want to continue redistributing the nation’s wealth upward to the privileged few or do we want a high standard of living for all Americans and a bright future for our children without the threat of global warming and environmental collapse?

We can’t have it all.

1 The DOD budget includes Overseas Contingency Operations (war costs) all supporting programs (State Department, CIA, FBI, etc.)

2 The Congressional Budget Office estimates that the tax cuts will add $1.8 trillion to the debt over the next decade.

3 This could easily have been predicted as tax cuts during the Reagan and Bush administrations similarly promised big returns for the Treasury that failed to materialize.

4 Social Security is excluded from this list as it is a separate, independent program paid for with Social Security premiums (so-called payroll taxes) and interest earned from the Social Security Trust Fund (about $3 trillion).

5 Since 1996, our defense spending has risen from $266 billion to $989 billion, and increase of $723 billion over 14 years. This amounts to a 9.83% increase per year compared to the average GDP increase of 7.04% over the same period. (These numbers do not take into account inflation that affects both equally.)

6 International Institute for Strategic Studies

7 In 1960 average healthcare costs per person per year were $146. In 2017, the average was $10,739 per person per year. This is an increase of 7,255% or an average of nearly 8% per year.

8 The median age of Americans in 2018 was 38 compared and the percentage of people over age 65 was 15% while the median age in 1970 was 30 and the percentage of Americans over 65 was 9.8%.